Ontario has seen a lot of mortgage regulation changes in recent years. In 2018, the Canadian Securities Administrators (CSA) released a series of proposed changes that would see the OSC assume responsibility for the oversight of mortgage syndication in the Province of Ontario. Mortgage syndicators are waiting with bated breath to see what finally comes from the recent interventions of two competing regulatory bodies into their market. We’ll walk you through the latest developments.

Key Points

- Previously, the regulatory environment was relatively light. Now, the first major proposed change is that mortgage syndications are no longer exempt from the Securities Act (Ontario). The mortgage syndicator will now only be able to choose between distributing the syndicated product in the (i) public markets pursuant to a prospectus filed and reviewed by the regulatory authorities (highly unlikely given costs) or (ii) private markets under the rules governing private placements.

- The new rules are thought not to come into force until late in the Spring of 2019, if not early summer. It is further anticipated that the mortgage brokerage community will be given an extra year to comply.

Who are the mortgage syndicators and what do they do?

Mortgage syndicators are syndicated mortgage brokers who are regulated by FSCO. In Ontario, only syndicated mortgage brokers (and their agents) are allowed to deal in or advise upon mortgages. Given the proximity to the market, syndicated mortgage brokers are the natural syndicators. The job of the mortgage syndicator is to initiate, promote and organise the syndicate.

A syndicate, by definition, is a self-organised group of people. A syndicated mortgage is a mortgage where there are two or more persons acting as lenders. The lenders have a direct beneficial interest in the underlying mortgage.

It’s attractive to be part of a syndicate as the investor (who now becomes a lender) is sharing the risk of being repaid by the borrower with other investors/lenders of like mind.

What are the new mortgage syndication rules?

Previously, the regulatory environment was relatively light. Now, the first major proposed change is that mortgage syndications are no longer exempt from the Securities Act (Ontario). The mortgage syndicator will now only be able to choose between distributing the syndicated product in the (i) public markets pursuant to a prospectus filed and reviewed by the regulatory authorities (highly unlikely given costs) or (ii) private markets under the rules governing private placements.

Mortgage syndicators will likely do the latter, yet it won’t be without its challenges. It is expected that the OSC will impose a registration requirement that will require mortgage brokers to successfully complete some series of courses that will eventually evidence their competence to solicit and sell in the exempt market.

Why did the mortgage syndication rules change?

First, it was to harmonize the rules of mortgage syndication across the country. In Ontario mortgages are currently exempt from securities law and the oversight of the OSC. Once the changes are adopted, there will no longer be exemptions from securities law anywhere across Canada and the placement of mortgage security would have to comply with the rules governing the private and public investment markets.

Second, at the time the amendments were announced, the mortgage syndication market was in turmoil, leaving many inexperienced investors exposed to questionable deal offerings made into the market by overly aggressive promoters.

The new rules are thought not to come into force until late in the Spring of 2019, if not early summer. It is further anticipated that the mortgage brokerage community will be given an extra year to comply.

CSA changes vs FSCO changes

Within a month of the CSA announcing its changes, FSCO released its intent to overhaul the rules governing mortgage syndication. Rather haphazardly, FSCO unleashed a web of policies and procedures. Where the OSC thinks it may take a year or two to bring the mortgage brokerage community into line, FSCO thought a few months adequate.

Instead of adopting the seasoned approach of the CSA, FSCO created a one-size-fits-all solution from which no market participant is exempt. The ensuing confusion and the abrupt cessation of market activity was not surprising. The new rules were described at the time of their introduction as transitional, yet as at the date mentioned above, no one knows how long transition is going to be or to what degree the regulators are cooperating.

The new mortgage syndication rules became effective July 1, 2018 — the same day many syndicators governed by FSCO gave up business.

Mortgage syndicators have a choice: embrace the changes imposed by FSCO now, or wait and see what the OSC will require?

Mortgage syndicators are stuck between a rock and a hard place. Embracing the FSCO regulatory regime today will involve significant cost and client interruption. (Further, there’s no guarantee that once the OSC publishes its rules, the syndicator will not have to go back and revisit all of the work they just put in place.) However, if the syndicator chooses to wait it out, he or she will likely lose business. What’s the answer?

What should mortgage syndicators do now?

There’s a way to circumvent FSCO’S transitional rules: Retain a private market intermediary to carry out mortgage participation transactions that comply with the Securities Act (Ontario) instead of the Mortgages, Brokerages, Lenders and Administrators Act (Ontario).

In Ontario, private market intermediaries are referred to as exempt market dealers (EMDs). EMDs are fully registered securities dealers who engage in the business of trading in prospectus exempt securities (which soon will include syndicated mortgages), or any securities to qualified exempt market clients.

Whereas a syndicate is a self-organized group, an EMD will represent a group organized by a third party. In the area of mortgages, it is common to organize groups under mortgage investment corporations (MICs), mortgage trusts (Trusts), or limited partnerships (LPs) whose sole business is investing in mortgages. In any of these examples, the EMD is not selling syndicated interests of mortgages, but rather shares in a MIC, units in a trust or limited partnership interests in a limited partnership.

The mortgage syndicator can continue advising on mortgages, but the EMD is responsible for qualifying the investors and providing the independent investment advice that marks best practice for the OSC.

How Fundscraper can help

Fundscraper is registered with FSCO as a mortgage brokerage and with the OSC as an EMD in the Province of Ontario as well as British Columbia, Alberta, Quebec and Prince Edward Island. We have spent the last two and a half years perfecting our online compliance procedures with the full expectation of the changes happening today in the mortgage syndication market. We discovered that by creating an interactive online environment we can greatly reduce the costs of compliance while delivering best-in-practice solutions. Once we qualify investors, we apply computer-generated algorithms to their investment decisions to assess suitability of investment and flag common investment risks. A qualified investor can begin our process and complete a subscription within twenty minutes from the comfort of their own home.

At Fundscraper, we also enhance distribution by making available, if a client so chooses, a product offering to a much larger educated audience than the client would have access to alone. Fundscraper is able to show syndicators how they can continue profitably in business and give them the comfort that between them and the regulator stands a seasoned platform that will shield them and provide protection for their investors. Having Fundscraper as a trusted partner puts the mortgage syndicator back in business.

Eliminate Compliance Issues

Ensure your compliance is current and up-to-date with the latest regulations. Our experts help companies ensure compliance, improve performance and more.

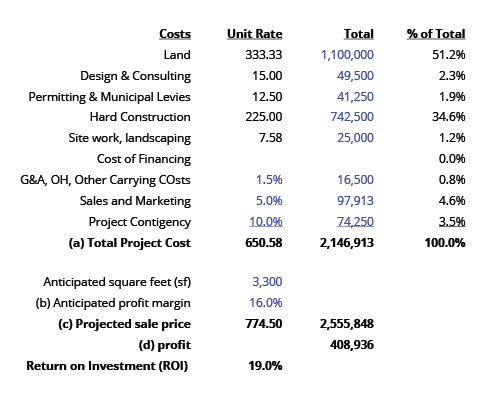

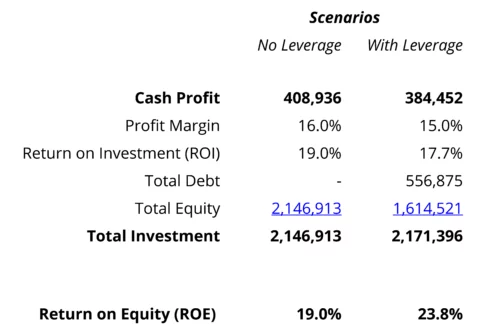

In the above No Leverage scenario, the developer maximizes the cash profit. However, they have to inject 2.146M of their own equity. For every dollar the developer invests, i.e. their equity injection, they will earn a 19% return or 19 cents for every dollar of equity. When a party invests for an ownership interest, then they have an equitable interest, or equity, and have a beneficial interest in the profits from the project. Put another way, an equity investor will likely expect or require a 19% return on their invested equity capital (the “expected return” or equity’s “cost of capital”).

In the above No Leverage scenario, the developer maximizes the cash profit. However, they have to inject 2.146M of their own equity. For every dollar the developer invests, i.e. their equity injection, they will earn a 19% return or 19 cents for every dollar of equity. When a party invests for an ownership interest, then they have an equitable interest, or equity, and have a beneficial interest in the profits from the project. Put another way, an equity investor will likely expect or require a 19% return on their invested equity capital (the “expected return” or equity’s “cost of capital”).

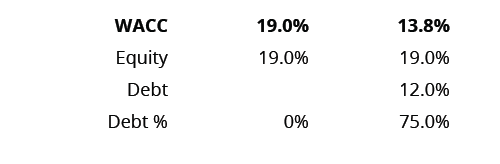

Your debt holders only demand 12%, but equity partners will want their 19% return. From a project point of view, the cost of that capital is going to be 19%! It’s the expected return your equity holders expect to receive by investing in the project. If you took on debt even at 12%, the math would work out to be 13.8%. So, overall, you can pay $0.138, or pay $0.19 for every dollar invested.

Your debt holders only demand 12%, but equity partners will want their 19% return. From a project point of view, the cost of that capital is going to be 19%! It’s the expected return your equity holders expect to receive by investing in the project. If you took on debt even at 12%, the math would work out to be 13.8%. So, overall, you can pay $0.138, or pay $0.19 for every dollar invested.