Put your registered funds to work for you. Our team put together a complete guide to funding your mortgage with RRSPs, including step-by-step lists, answers to all your tax questions, and real-life examples of how much you could be making.

Key Points

- What Are Registered Funds?

- How to Use Your Registered Funds to Fund Your Mortgage

- Pros of Using Your Registered Funds to Fund Your Mortgage

- Cons of Using Your Registered Funds to Fund Your Mortgage

- Important Considerations for Using Your Registered Funds to Fund Your Mortgage

- 5 Steps to Using Your Big Bank RRSP to Buy Non-Bank Products

- How Do I Get Started?

Most people don’t realize they can invest in private mortgage investment entities like mortgage investment corporations and mortgage trusts, as well as mortgages directly, with their RRSPs. Interested in learning how to invest with your registered funds? We’ll walk you through it.

What Are Registered Funds?

A registered retirement savings plan (RRSP) is a type of Canadian account for holding savings and investment assets. RRSPs are the most popular and well-known registered plans in Canada. They’re established by individuals or often by individuals together with their employers.

RRSPs must comply with a variety of restrictions stipulated in the Canadian Income Tax Act. Approved assets include savings accounts, guaranteed investment certificates (GICs), bonds, mortgage loans, mutual funds, income trusts, corporate shares, exchange-traded funds, foreign currency, and labour-sponsored funds.

These are all called “registered” plans, meaning that they are recognized by our revenue authorities as tax-incentivised wealth management accounts. All of these plans are registered with the Canada Revenue Authority and are provided by approved service providers like banks, trust companies, and insurance companies. Contributions can be made on your own behalf or on behalf of your spouse up to and including the year you and your spouse turn 71.

Once money is deposited into an RRSP, the tax payable on that money (and any money that is earned by investing that money!) is deferred until it is withdrawn.

RRSPs have various tax advantages compared to investing outside of tax-preferred accounts. To encourage people to save for retirement, the Canadian government allows us to contribute a certain fraction of our yearly salary every year without taxing us on it today. Once money is deposited into an RRSP, the tax payable on that money (and any money that is earned by investing that money!) is deferred until it is withdrawn. You pay tax on it when you withdraw – either in a moment of need or at the time you retire. If you withdraw it before your retirement, then you will pay all the tax at once on the amount withdrawn. If you wait until you retire, you pay tax on it (and whatever has accumulated on it) gradually over a period of time until the funds are exhausted.

This applies to Registered Retirement Income Funds (RRIFs) and Tax-Free Savings Accounts (TFSAs) as well.

Did you know you can use registered funds to fund your own mortgage?

If you are making $100,000, the government will allow you to contribute 18% of your earned income (or a maximum of $27,230 for the 2019 tax year). If you make the maximum contribution, the government would only tax you on $72,770!

How to Use Your Registered Funds to Fund Your Mortgage

To become both the lender and the borrower, you have to set money aside in RRSP accounts. The larger the RRSP, the more mortgage you can create. First, figure out how much of a mortgage loan you can create with the RRSPs you have on hand. (Your monthly RRSP statements will provide that number. Not sure? We can help!)

Those RRSP funds are likely tied up in mutual funds, exchange-traded funds, and other pooled RRSP eligible accounts. To fund a mortgage, these RRSP accounts have to be reduced to cash. Once you have made the decision to fund your mortgage with your own RRSP funds, you will instruct whoever has custody of your RRSPs to sell everything in the account so that the only thing that remains in the account is cash. If you remember one thing, make it this: IT IS IMPERATIVE THE CASH STAYS IN THE ACCOUNT. You are not withdrawing the cash; you are simply reducing whatever is in the account to cash.

When you reduce your RRSP account to cash to fund a mortgage, it is imperative the cash stays in the account. You are not withdrawing the cash; you are simply reducing whatever is in the account to cash.

Next, you will instruct your financial institution to open up a “self-directed RRSP.” It may be most expedient to work with the approved lender required in this transaction. The lender will require you to open an account, which will take very little time.

Once the account is established, you have to fill up your newly created self-directed RRSP account. You will do that with the assistance of the lender who has helped you set up the account. You will complete a “transfer instruction” whereby your lender will request all the other institutions who currently hold your RRSP accounts (that now hold nothing but cash) to transfer all the cash that is in those accounts to your newly created self-directed RRSP account. Once all the forms are completed, the transfer can take up to four weeks.

To maintain RRSP eligibility, funds must move directly from one RRSP account to another – regrettably, you cannot simply withdraw the funds and walk them across the street and deposit them.

Once the funds arrive in your self-directed RRSP account, it’s time for the fun part: telling the self-directed RRSP account to fund a mortgage! You do that by way of delivering to the lender a “payment direction,” which tells the lender to buy the mortgage from you on behalf of the RRSP account for the amount set out in the direction. The lender then forwards the cash to your lawyer, who will now register the loan against the land title to create the mortgage – the mortgage, now registered in the name of the self-directed RRSP and administered by the lender. The mortgage will have the benefit of insurance, most likely arranged by the lender approved to administer the mortgage.

Now you are set and you begin making payments on the mortgage as you would under any other mortgage arrangement.

Pros of Using Your Registered Funds to Fund Your Mortgage

- You make interest payments to yourself instead of a financial institution, creating immediate cash flow.

- The RRSP benefits from the interest costs. The longer the amortization period of the mortgage, the more RRSP you create.

- Monthly mortgage payments that repay the RRSP loan with interest do not count as contributions and you can still take advantage of maximum contribution room.

- It provides a low-risk investment with a predictable return.

Cons of Using Your Registered Funds to Fund Your Mortgage

- Setting up and administering the RRSP is complex.

- Insurance, legal and start-up costs, and administrative fees are high.

- RRSP funds are tied up at the cost of other investment opportunities.

- It may inadvertently over-concentrate your retirement portfolio in one investment product.

If your self-directed RRSP account buys from you a $200,000 mortgage that has a 25 year amortization period at a commercial rate of interest, you double it over the period without ever encroaching your contribution room!

Important Considerations for Using Your Registered Funds to Fund Your Mortgage

The mortgage, notwithstanding it is from you to you, has to be legitimate.

Many Canadians hold their RRSPs through “client-held accounts” at various investment and/or fund companies. Every time one opens an account with a different investment company or fund manager, a new account is created. These accounts are generally specific to the investment product being subscribed for at the time. It is not uncommon for Canadians to have several of these kinds of accounts.

The other popular form of account is a “nominee account”. Essentially this is one account held by a “custodian” or “trustee” that holds several different kinds of investments on your behalf. You need to employ a special kind of RRSP nominee account when you want to use your RRSP funds to finance your own mortgage – that account is called a “self-directed RRSP” and they are widely offered by financial institutions in Canada.

Two main takeaways:

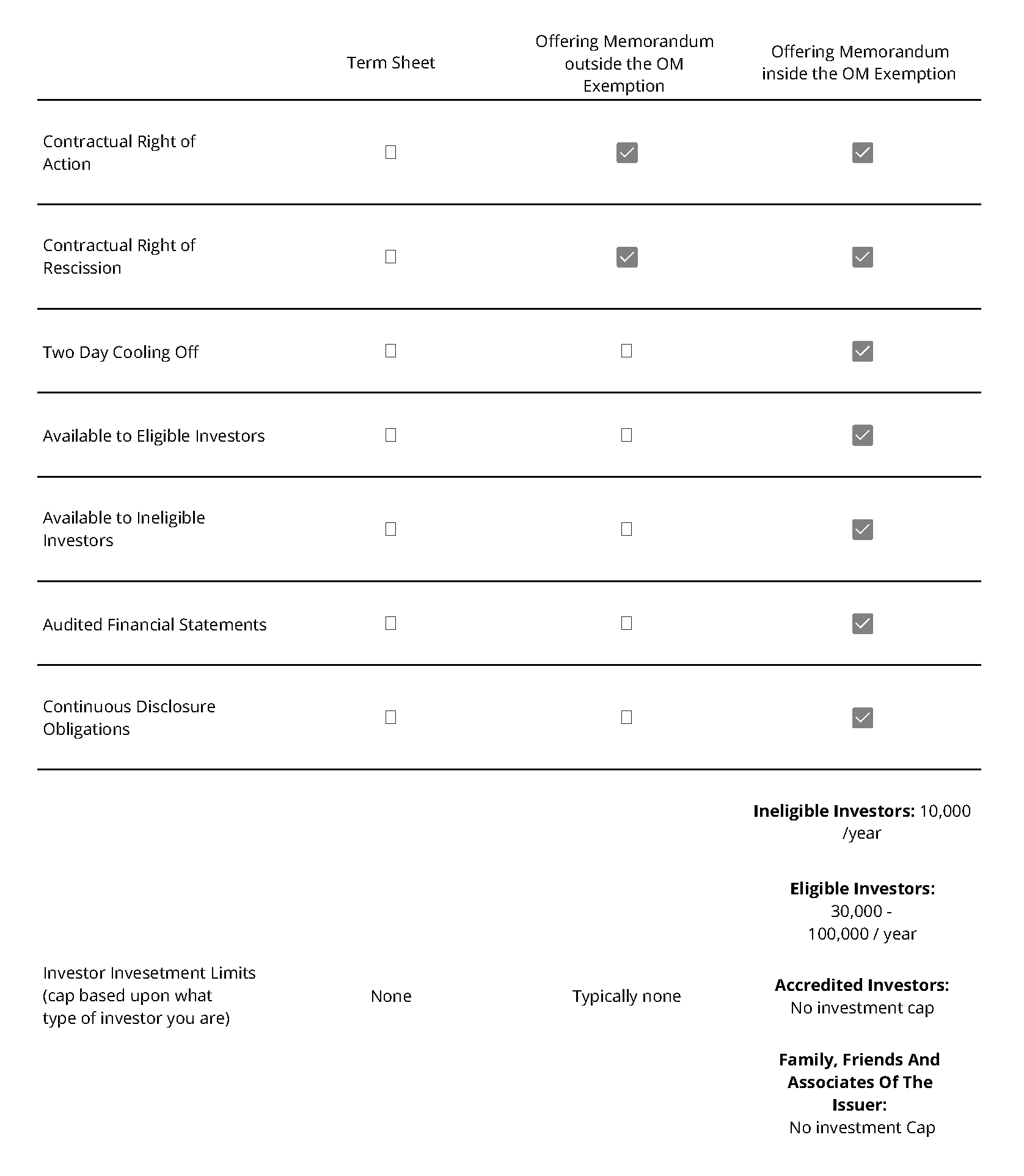

1. The mortgage has to be insured by either CMHC or a private insurer. 2. The mortgage has to be administered by a lender approved by the National Housing Act.

5 Steps to Using Your Big Bank RRSP to Buy Non-Bank Products

- Confirm the non-bank product is RRSP eligible with the help of a licensed advisor like Fundscraper.

- Identify how much you want to invest in the non-bank product.

- Instruct your bank to reduce to cash that amount WITHIN your RRSP account – your account will thereafter have a component of bank product and cash!

- Open up a self-directed RRSP account.

- Transfer the cash component to the self-directed RRSP.

- Issue a payment instruction telling the self-directed RRSP what to buy.

How do I get started?

This investment strategy is less common, as only a very few can take full advantage of the substantial benefits it offers. Nevertheless, mortgage investment is an imperative in anyone’s portfolio. If you’re looking to engage in this strategy, it’s critical that you speak to a qualified financial advisor — like us! — before moving any money. Fundscraper can help you do an appropriate assessment of the risks and costs associated with this investment approach.

If funding your own mortgage is not an option available to you today, you still have other options. Join our community of investors to learn more about private property and mortgage investment, and how it fits into your portfolio and investment strategy.