Category: Help & FAQ

How does the payment process work?

The primary way to receive your dividends or distributions is via an ACH transaction from a linked bank account. You can link your bank account either by

1) directly entering your routing and account numbers or

2) manually filling out our PAD form.

The primary way to fund your investment is via an ACH transaction from a linked bank account. You can link your bank account either by

1) directly entering your routing and account numbers or

2) manually filling out our PAD form.

For certain orders above $25,000 we do accept wires. We are unable to accept orders via credit/debit cards or from savings accounts.

Is there a limit to how much money I can invest?

Your Investor Type determines how much you can invest annually.

- Accredited: No Investment Limit

- Eligible: Invest up to $30,000/year

- Ineligible: Invest up to $10,000/year

Create your profile and answer our KYC questionnaire to find out what type of investor you are.

If you have already created your profile, you can find your investor type and remaining available investment limit on your Dashboard profile.

Is this a syndicated mortgage?

No, an investment in an FPT unit is not a syndicated mortgage. You are a unit holder in FPT which in turn typically invests in a limited partnership holding the real estate investment pursuant to the terms of a limited partnership agreement.

Can I invest with registered funds (RRSP, TFSA, etc.)?

Yes. Read this article to learn how to invest with your registered savings fund.

And watch this webinar below.

What kind of returns can I expect on my investments?

If you invest in Fundscraper Property Trust you have options available that are designed to reflect your appreciation for risk. For investors looking for diversification we have “pools” of mortgages from which investors can choose. We have conservative pools of mortgage investment and an advertersome pool for those who feel that they can tolerate a little more risk for a higher return. We also have pools that are constituted by specific opportunities in which you are able to invest with us well. These are unique financings the Trust has underwritten in which you are welcome to participate through the Trust. Each project has a unique projected return profile that we describe in the supplemental postings we supply to Offering Memorandum.

How is Fundscraper Property Trust different from a Private Real Estate Investment Trust (REIT) or a MIC?

Fundscraper Property Trust (“FPT”) is a private investment vehicle classified as a “mutual fund trust” under the Income Tax Act which sells units to investors and then uses a pool of capital to invest in private mortgages, collects monthly interest, and passes that to its unit owners as monthly income. FPT offers different secured mortgage asset pools that, while they are not guaranteed or insured, are reflective of risk tolerance and suitable for registered user’s goals. You can invest in Fundscraper Property Trust with as little as $5,000. In some cases, units offered by FPT will be eligible for Registered Funds like RRSPs, RRIFs, and TFSAs.

When you invest in a public mutual fund, the fund managers invest your money, along with the money of all the other unitholders (investors in the fund), in a portfolio of investment assets that might include equity securities (stocks), debt securities (bonds), Treasury bills and more. Mortgage Investment Corporations (“MICs”) are public vehicles which pool mortgages. Private REITs are real estate funds or companies that are exempt from SEC registration and whose shares do not trade on national stock exchanges. Private REITs generally can be sold only to institutional investors.

Can I invest jointly with a third party?

Yes.

Can I invest with other types of legal entities?

There are generally 2 types of investment entities you can add to your individual profile; Trust and Corporate. After successfully adding the investment entity, you then can invest using the corporate entity or trust vehicle.

For instructions on setting up Corporate entities, see below.

For instructions on setting up Trust entities, scroll down to the ‘Trust’ section.

Corporate

How do I set up a corporate entity?

Watch our how to video below:

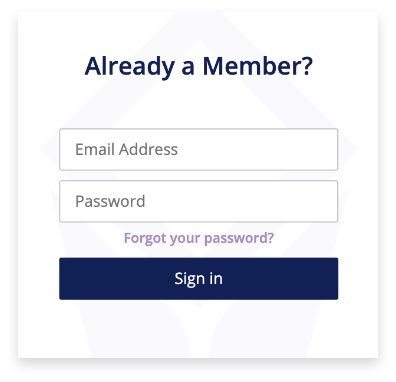

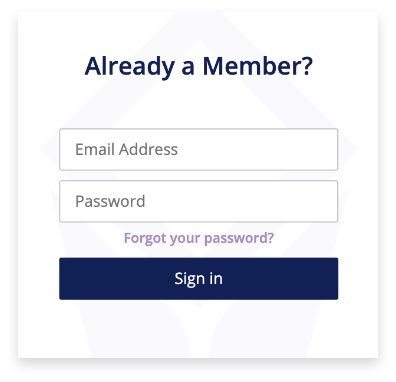

- To set up a corporate entity, please log back into your individual account here: www.fundscraper.com/login

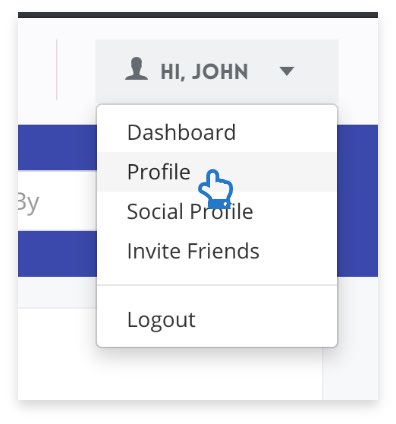

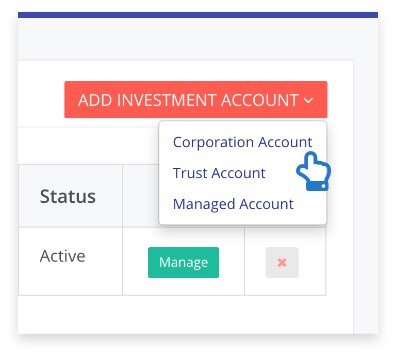

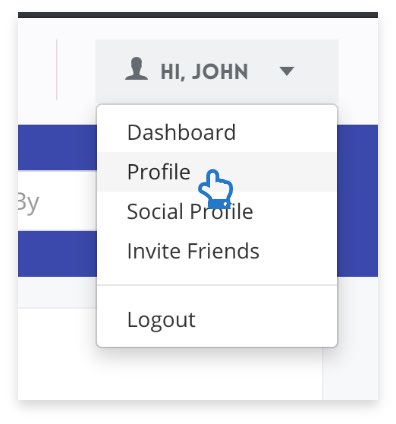

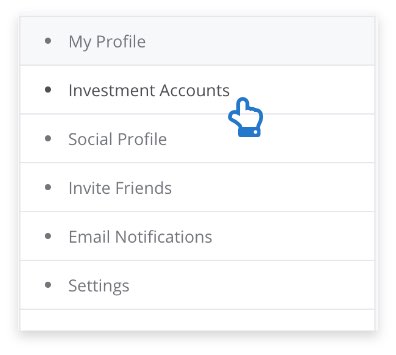

- Scroll to the top, hover over your name, click on the drop down, click ‘Profile’.

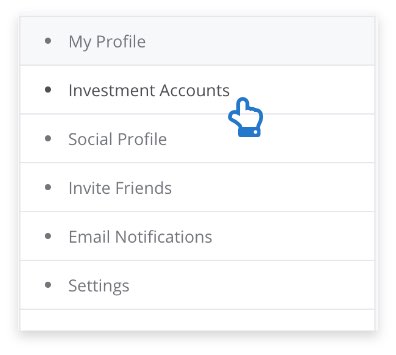

- On the next screen, on the left hand side menu, click ‘Investment Accounts’.

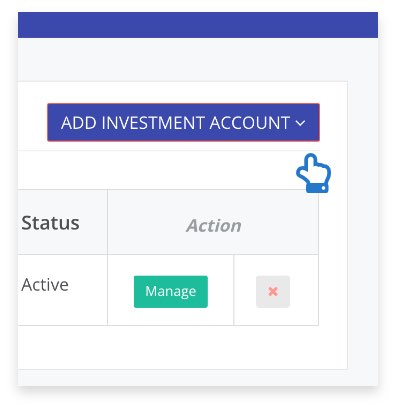

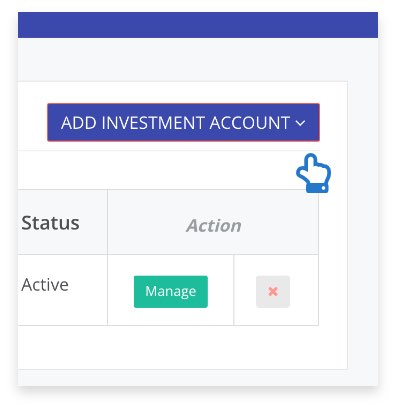

- On the screen, click ‘Add Investment Account’.

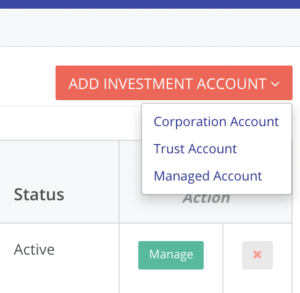

- Select ‘Corporation Account’,

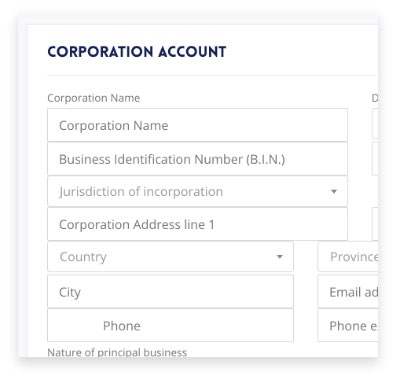

- On the form that shows up on the screen, please fill in the KYC information from the perspective of the corporate entity.

Please note that any shareholder with more than 25% ownership will be required to complete an individual KYC as well.

Information to have on hand during the corporate KYC completion process:

- Business number

- Incorporation date

Trust

How do I set up a Trust?

- To set up a corporate entity, please log back into your individual account here: www.fundscraper.com/login

- Scroll to the top, hover over your name, click on the drop down, click ‘Profile’.

- On the next screen, on the left hand side menu, click ‘Investment Accounts’.

- On the screen, click ‘Add Investment Account’.

- Select ‘Trust Account’

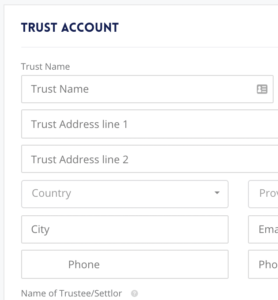

- On the form that shows up on the screen, please fill in the KYC information from the perspective of the Trust entity.

Information to email Fundscraper (team@fundscraper.com) upon completion:

- The legal status of entity (trust certificate, trust deeds, incorporating documents, custodian agreement document, articles of constitution, partnership agreements, shareholder agreement).

- Authorization document certifying you as the Trustee.

- Tax identification number for out-of-country trusts.

For more information on how to invest with your corporate entity or other investment vehicle see: How do I invest through a business account?

How do I invest or complete an investment?

Watch our how to video below:

- Once you’ve decided on an investment opportunity, click the orange “Invest” button in the top-right hand of the product offering page.

- To start an order, input the number of units to generate your total investment.

- Select if you will invest as an individual or through an investment entity. Instructions on how to add a corporate or trust entity can be found here.

- Select if you are using registered or non-registered funds. If you are investing with registered funds, be aware that Canadian Tax regulations require investors to use registered funds processed through a trust company designated by the issuer. You will not be able to use funds domiciled with another financial institution.

- If you have a company with the trust company, indicate your account number under the Investor Information section.

- Select whether you’d like to automatically reinvest the cash dividends into the investment.

- Select whether you will be making the investment jointly with another investor. Once you add a joint subscriber once, you will not need to add their information from scratch for subsequent orders.