With so many investment options for your registered account, you may be asking, Why should I care about private real estate investments?

The private mortgage market provides a fixed-income alternative for investors looking to diversify away from government bonds and corporate debt. It also provides the opportunity to generate a generally predictable yield compared to some traditional fixed-income vehicles in a low interest-rate environment.

If you’re new to the world of real estate investment, you probably have some questions about your options. Let’s walk through a popular type of registered retirement life income funds (RRIF) offered in Canada: the life income fund (LIF) as well as LIF minimums and maximums.

What are LIF Minimum and Maximum Withdrawals?

A LIF or life income fund is a type of registered retirement income fund (RRIF) offered in Canada that can be used to hold locked-in pension funds as well as other assets for an eventual payout as retirement income.

Owners must use the fund in a manner that supports retirement income for their lifetime. Each year’s Income Tax Act specifies the RRIF withdrawal amounts, including the LIF minimum and maximum withdrawal amounts.

You must be at least of early retirement age (specified in the pension legislation) to purchase a LIF and begin receiving payments.

Why is it Important to Know My LIF Maximum Withdrawal?

The Canadian government regulates various aspects of life income funds, in particular the amounts that can be withdrawn, which are specified annually through the Income Tax Act’s stipulations for RRIFs.

Most provinces in Canada require that life income fund assets be invested in a life annuity. In many provinces, LIF withdrawals can begin at any age as long as the income is used for retirement income.

Once an investor begins taking LIF payouts they must monitor the maximum LIF withdrawal amount. The federal LIF maximum amounts are disclosed in the annual Income Tax Act, which provides stipulations pertaining to all RRIFs. The maximum RRIF/LIF withdrawal is the larger of two formulas, both defined as a percentage of the total investments.

Ready to Start Investing with the Help of Seasoned Experts? |

The financial institution from which the LIF is issued must provide an annual statement to the LIF owner. Based on the annual statement and the LIF maximum withdrawal amount, the LIF owner must specify at the beginning of each fiscal year the amount of income they would like to withdraw. This must be within a defined range to ensure the account holds enough funds to provide lifetime income for the LIF owner.

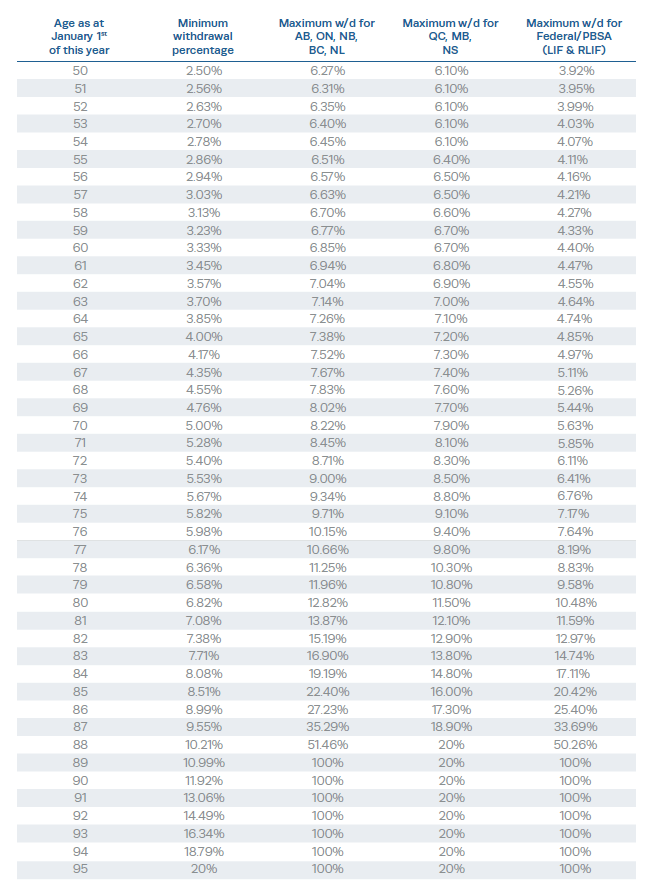

LIF Maximum Payment Amount Table

Below is the LIF maximum payment amount table showing the minimum and maximum withdrawal percentages for LIF and RLIF accounts in 2021 by province. Depending on your age or your spouse’s age (whichever you select), you must withdraw an amount between the minimum and maximum amounts as outlined by the percentages below.

An example calculation is included below; however, if you still need assistance with determining your withdrawal options, we recommend that you contact an investment professional.

Notes

- Quebec, Alberta, Manitoba, New Brunswick, and British Columbia pension legislation permits LIF clients who begin a LIF in the middle of a calendar year with funds transferred from a LIRA or pension plan to take the FULL maximum payment for the year. First year payments under the other jurisdictions must be prorated based on the number of months the LIF was in force.

- ON, BC, AB, NL maximum calculations are based on the greater of a) the result using the factor and b) the previous year’s investment returns. MB LIF maximum calculation is based on the greater of a) the result using the factor and b) the previous year’s investment returns + 6% of the value of all transfers in from a LIRA or Pension Plan during the current year.

- Saskatchewan Prescribed RRIF – there is no maximum annual withdrawal and you can withdraw all the funds in one lump sum.

How Can I Use My LIF to Invest in Real Estate?

LIF owners can choose their own investments (as long as the investments qualify). Qualified investments in a LIF include cash, mutual funds, ETFs, securities listed on a designated exchange, corporate bonds, and government bonds.

Unlike some other alternative investments, private real estate investments such as mortgage investment corporations and real estate investment trusts can be incorporated into your RRIFs including LIF, allowing you to grow your portfolio while enjoying tax-deferred status.

Like other registered products, contributions grow tax-deferred within a LIF. Funds within a LIF are creditor-protected and can’t be seized to pay off debt obligations. Contributions can grow tax-deferred until the year after you turn 71.

Want to Learn More About Investing with Mortgages? Check out these Blogs. The New Mortgage Syndication Rules For Non Qualified Syndicated Mortgages |

Of course, there are also disadvantages to setting up a LIF. For example, a minimum age requirement applies to both starting a LIF and receiving LIF payments. Furthermore, the maximum withdrawal limits prevent you from accessing more income when you need it. If you’re new to real estate investing, adding such a large asset to your portfolio may seem intimidating.

But it’s easier and more attainable than you might think. I invite you to check out our marketplace and education centre, which has articles, webinars, tools, and more informative videos for investors of every experience level.

See what it takes to invest with Fundscraper, and how easy it can be! |

Life Income Fund FAQs

At What Age Can You Withdraw Money From a LIF?

You can withdraw money at 55 years old. No withdrawals from a LIF are permitted before age 55.

Is LIF Income Taxable?

Yes. LIF income is taxable and must be added to your annual income. If the withdrawal is higher than the annual minimum withdrawal, taxes are withheld on the excess amount.

What Happens to a LIF When You Die?

Upon death, the balance of your LIF is paid to your spouse. If your spouse denies payment or if a spouse is absent, it is paid to your heirs.

3 Key Takeaways of this Article

- A LIF or life income fund is a type of registered retirement income fund (RRIF) offered in Canada that can be used to hold locked-in pension funds as well as other assets for an eventual payout as retirement income.

- Owners must use the fund in a manner that supports retirement income for their lifetime. Each year’s Income Tax Act specifies the RRIF withdrawal amounts, including the LIF minimum and maximum withdrawal amounts.

- The Canadian government regulates various aspects of life income funds, in particular the amounts that can be withdrawn, which are specified annually through the Income Tax Act’s stipulations for RRIFs.

Fundscraper Capital Inc. and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.