What is a REIT in Canada?

If you’re considering real estate investment strategies such as direct property ownership and buying residential or commercial real estate properties, or you’re an experienced investor

Fundscraper connects you to a premiere network of proven Private REITs. Start your free account to explore opportunities today.

|  |  |  |  | Minimum Investment Amount | $25,000 | $5,000 | $25,000 | $10,000 | $10,000 |

|---|---|---|---|---|---|

Registered Funds Eligibility | Yes | Yes | Yes | Yes | Yes |

Target Annual Net Return * | 7.0-12.0% | 8.0-12.0% | 8.0-12.0% | 9.0-11.0% | 12.0-15.0% |

Cash Distribution Yield | 4.27% | 5.09% | 5.82% | 4.0% | 7.0% |

Current Unit Price** | $23.39 | $11.78 | $12.37 | $5.20 | $11.50 |

View Listing | View Listing | View Listing | View Listing | View Listing |

*Past performance is not indicative of future performance. Always review the offering documents and seek professional financial or tax advice before investing.

**A comparison of the Private REIT offerings in Fundscraper’s Marketplace as of March 23, 2023.

How your money will make money.

A real estate investment trust, or REIT, is a company that makes investments in income-producing real estate.

Investors who want to access real estate can, in turn, buy units of a REIT and through that share ownership effectively add the real estate owned by the REIT to their investment portfolios. Unitholders are taxed upon receipt of distribution.

If you’re considering real estate investment strategies such as direct property ownership and buying residential or commercial real estate properties, or you’re an experienced investor

The following article will walk you through why investing in real estate investment trusts are advantageous, the different types of REITs, pros and cons of

Investing in real estate is one of the smartest moves you can make, no matter what age or stage of life you are in. Real

Once a fund successfully qualifies as a REIT, investors can buy shares in a variety of ways. The REIT pools this capitalization to make investments in different kinds of real estate investments. Investments can include the REIT’s direct ownership of real estate, real estate loans, or both.

REITs can be classified in 3 ways:

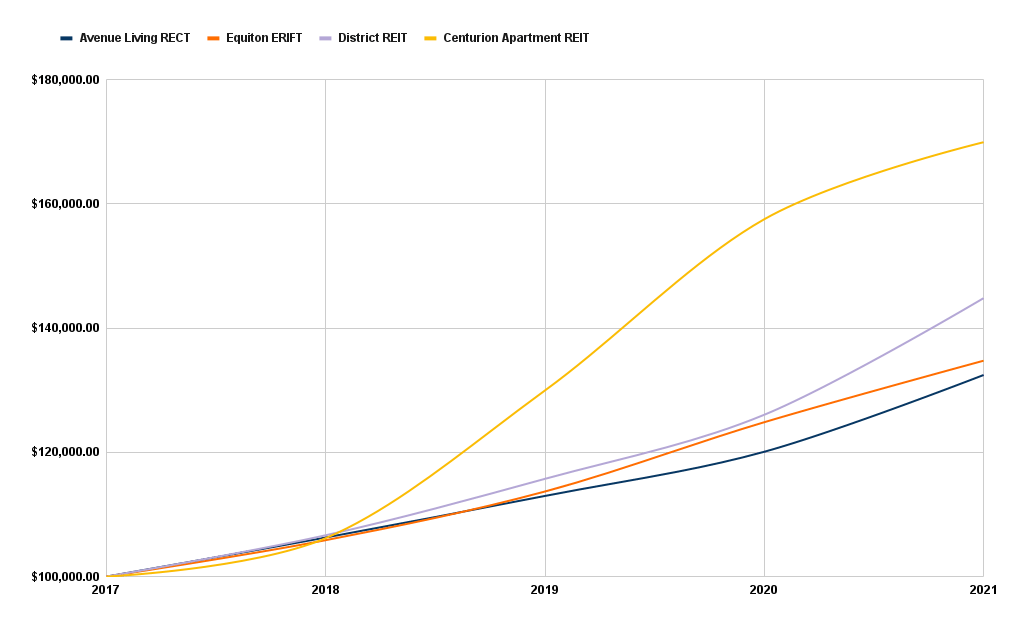

As with a mutual fund, each share of a REIT represents partial ownership of all the individual assets held by the fund. Therefore, any change in the value and price of a REIT’s shares reflects the change in the value of the overall collection of individual real estate properties the REIT holds. Also like a mutual fund, REITs are professionally managed by one or more fund managers, who determine and implement the REIT’s investment strategy.

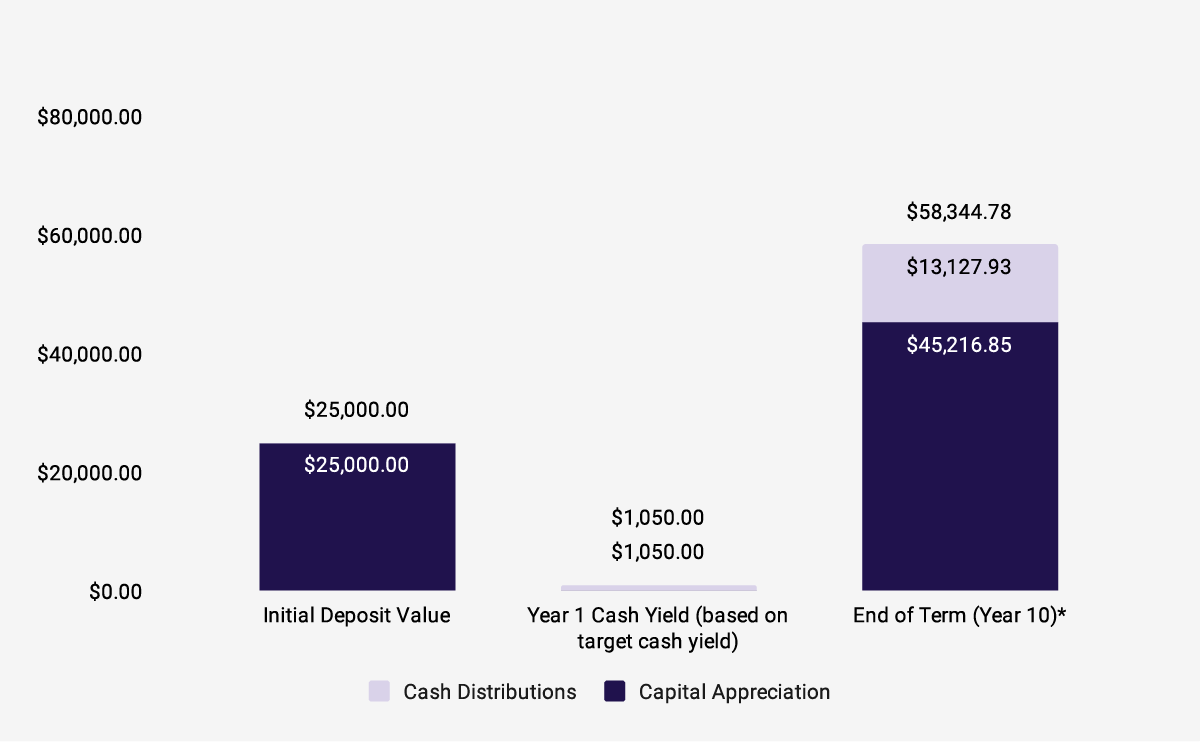

Just as REITs can earn returns in the form of income or appreciation, REIT investors can also realize the same types of returns. For income-generating investments, REIT investors typically realize returns through dividend distributions, which represent the income earned by individual real estate properties. Dividend distributions are typically paid to investors by the REIT in proportion to their share of ownership of the entire fund on a regular basis.

Meanwhile, in order to realize appreciation-based returns, an investor generally must sell his or her REIT shares. Unlike income, which can be distributed to an investor on a regular basis, appreciation is generally realized upon sale of shares in a single, lump sum return. That said, when a REIT sells an underlying property, capital gain dividends can be distributed to investors without requiring those investors to divest of their shares. Typically, any appreciation realized in this way by an investor on an equity investment (REITs included) is categorized as a capital gain.

Fees to hold your units will vary by issuer, but may include account opening fees (in the case of registered funds accounts), issuer’s management fees and operating fees, and sometimes a percentage of profits in the form of a promoted interest or performance based fees. We recommend investors review in detail the offering memorandums of each individual offering to see a more comprehensive listing of fees. However, any projected returns shown are net of management fees charged by the issuer.

Typically $10,000 – $25,000; private REITs that are designed for institutional investors generally require a much higher minimum investment. However, click to view the detailed offerings to see the specific minimum investment applicable for each offering.

Private REITs are sold to investors through specialized dealers in the exempt market like Fundscraper. Private REITs are not traded on a stock exchange, so there are transfer, redemption, and resale restrictions on those units. Thus, private investments are not as liquid as publicly traded investments.

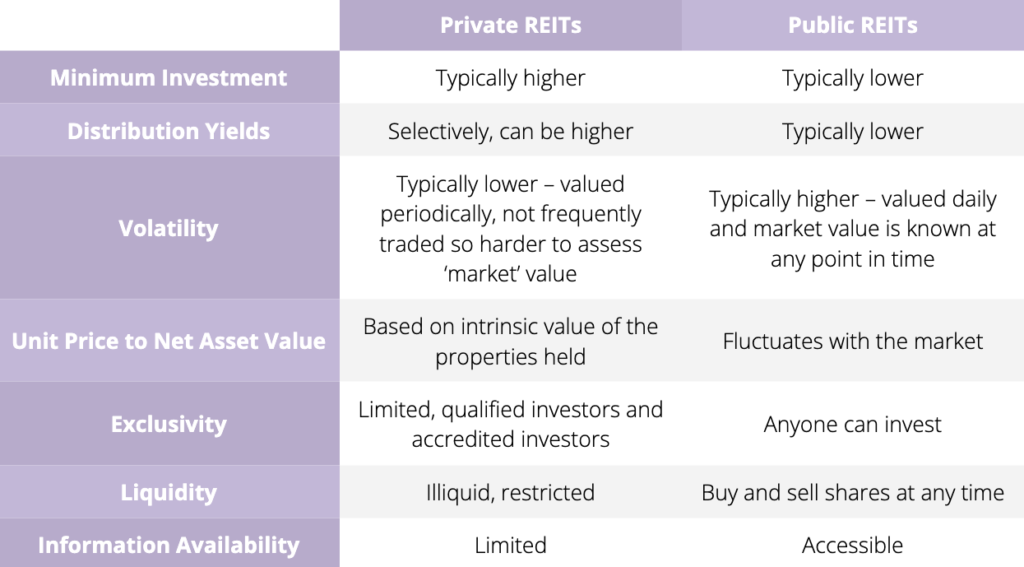

These are the basics about why certain investors prefer private REITs to public REITs.

Make sure you meet the eligibility requirements by signing up for a free account.

Review the prospectus and connect with our licensed experts to discuss your options.

Plan to diversify, which means investing in small amounts to lower your overall portfolio risk.

Receive updates and enjoy passive returns until the completed term or re-invest for compound growth.

FSRA #12859 | NRD #53460

SECURITIES DESCRIBED ON THIS WEBSITE ARE OFFERED BY FUNDSCRAPER CAPITAL INC. IN ITS CAPACITY AS AN EXEMPT MARKET DEALER REGISTERED WITH THE ONTARIO SECURITIES COMMISSION (AND EQUIVALENT REGULATORY AUTHORITIES IN OTHER JURISDICTIONS IN CANADA) AND NOT IN ITS CAPACITY AS A MORTGAGE BROKERAGE UNDER THE FINANCIAL SERVICES REGULATORY AUTHORITY OF ONTARIO.

The information presented on this website may consist of investment opportunities that include projections and forecasts based upon information, including forward-looking assumptions and estimates. There can be no assurance whatsoever that these projections and forecasts will be achieved. Readers should refer to the offering documents contained within each investment opportunity only for full details including risks relating to such opportunities. In addition, Readers should consult with their investment advisor and other advisors, including legal and tax, before making any investment through Fundscraper. Fundscraper may also be a “related” issuer (as such term is defined in National Instrument 33-105—Underwriting Conflicts) of a party offering securities on this website. Readers who are considering purchasing any investment from this website should read the applicable offering materials, including any related offering memorandum, before making an investment decision.

Information provided on this website is for the confidential use of only those persons to whom have qualified access to the Fundscraper website. Any offering materials provided on the site constitute an offering of securities only in those jurisdictions and to those persons where and to whom they may lawfully be offered for sale. These offering materials are not, and under no circumstances are to be construed as a prospectus or an advertisement for a public offering of these securities. No securities commission or similar authority in Canada or elsewhere has in any way passed upon the merits of the information on this site or securities offering in the offering materials and any representation to the contrary are an offence. Persons who acquire securities pursuant to the information on this site and offering materials provided on this site will not have the benefit of the review of these documents by any securities commission or similar authority.

Fundscraper is a registered trademark of Fundscraper Corp. and its affiliates.

© 2016-2022, Fundscraper Capital Inc. All Rights Reserved.

Become a master of real estate investing! This playbook has inside industry knowledge that you can use to help generate passive income! Discover tactics used by the savviest investors, how to diversify, maximize your returns and avoid mistakes. It’s everything you need to know to invest like a pro.